Energy Independence

The 21st Century Energy Initiative

Sunday, November 30, 2008

Helping the Economy...

helps renewable energy

With energy prices dropping significantly, the perceived "pressure" to solve our energy problems reduce, too. When we come out of the recession (or worse), Peak Oil (supply) and China/India growth (demand) will make things much much worse - and may cause an even greater energy-price economic crunch than we're seeing today.

Therefore, due to the difficult economy we face, I have decided to do my part - and give away copies of my latest book: "How to Attract Significantly More Customers... in good times and bad."

I believe businesses will pull us out of this deepening recession: With the economy the way it is, I hope to help thousands of business owners make both strategic decisions and strategic changes, to grow their way out of our difficult economic malaise. In doing so, they hill hire more people and reduce joblessness. Thereby creating an environment where - once again - renewable energy solutions will overtake the economy as the #1 issue.

If you know any business owners who could benefit from new insights, please forward the following URL to them: http://www.synergy-usa.com/SCQ.html. Thank you.

Labels: Commercialization, Invest in the Future, Make a Difference, More important information, Real Solutions

Wednesday, November 26, 2008

Guest blog:

Scott Alexander tells it like it SHOULD BE!

"It's shameful that our government would rather spend $25 billion bailing out an automobile industry that was burning $1 billion per month during the peak of the housing / borrowing / spending boom, than to set up a $25 billion venture fund so start-up companies that can't be self-funded have a chance at making it.

Tesla (the electric car company run by former PayPal co-founder Elon Musk) hit the nail on the head when they petitioned the government for $400 million from the American Auto Industry bail-out proposal.

Hmm. Give $400 million to a company that will use the money to bring American made commercially viable electric vehicles to world market years ahead of any other nation, or give $25 billion to failing poorly managed companies that will use the funds to pay off the unions to allow them to lay people off. Seems like a no-brainer.

I hope Obama has the right mix of Liberal and Conservative that this nation needs. It must be tough times for libertarians :) !"

Scott Alexander, CEO - XanderDev

Labels: Invest in the Future, Real Solutions

Tuesday, November 25, 2008

California increases RPS from 20% to 33%

On November 17, 2008, Governor Schwarzenegger signed Executive Order S-14-08, revising California's existing Renewable Portfolio Standard (RPS) upward to require all retail sellers of electricity to serve 33% of their load from renewable energy sources by 2020.

Although this is good news from a renewable energy perspective, changing things mid-stream is not ethical, and will cause all kinds of problems. It's similar to having the wind investment tax credit expire every year. Makes no sense. We need to set fixed-requirements, then let the prepar for, and then market deal with it. In a logical, planned manner!

Labels: Political Action, Unintended Consequences

Saturday, November 22, 2008

Fisker Automotive: 50 miles radius plug-in: Wow!

Looks like Fisker Automotive has outdone Tesla motors. They went for a shorter driving distance, and built in a 4-cylinder gas engine for >50 miles. (The average miles driven per day is fewer than 50 miles... 80% of the time.) They also won a court battle against Tesla. Let the electric-car wars (i.e., competition, driving down electrics) begin!

Labels: Invest in the Future, Real Solutions

Friday, November 21, 2008

Obama's plan enough?

A recent article indicates that Obama's plan is insufficient. Those to the left talk about climate change. Those to the right talk about energy security. Either way, we will need to do more than Obama's plan indicates. (An assessment of Obama's plan vs. what is needed can be found here.)

More importantly, we will need to be innovative about how we spend money. Please - don't just throw money at the current "system" for commercializing energy technologies. It hasn't worked. Innovative, even disruptive business models need to be developed and funded. One such innovative approach is NXergy, Inc.

Labels: Commercialization, Invest in the Future, Real Solutions

Can we learn from nature? (To create renewable energy?)

According to a recent report, a University of Michigan engineer has made a machine that works like a fish to turn potentially destructive vibrations in fluid flows into clean, renewable power.

Watch the video. Check out the company.

Labels: Commercialization, Real Solutions

The Cost of Cap & Trade

According to the Congressional Budget Office, Cap & Trade Act (S. 2191 America's Climate Security Act of 2007) would cost over $1.4 trillion over the next 10 years (assuming the 2018 "run rate" for 2019). Although the first three years cost "only" $15 billion, beginning in 2012, the cost is $150 billion per year and over $300 billion / year by 2018.

Just thought this information is important to share.

Labels: More important information

Energy Storage Technology Gains Traction

Smart grid startup GridPoint Inc. got into the utility power storage business Tuesday, announcing that utility Xcel Energy had chosen its software to manage a wind power battery storage project.

GridPoint raised $120 million in September and bought Seattle-based V2Green, a company that makes technology to allow plug-in vehicles to communicate with and provide power back to utilities. GridPoint previously had raised roughly $102 million before that in four rounds of funding, with investors including Goldman Sachs Group and Susquehanna Private Equity Investments, New Enterprise Associates, Perella Weinberg Partners, Robeco and the Quercus Trust.

Labels: Invest in the Future, Real Solutions

Blog worth checking out! (Greenbang.com)

Greenbang tracks the explosion of the environmental industry, reporting on news of green innovation and clever business people.W e blog on this rather than the environmental problems of the world because we are interested in the answers - if there are any.

Greenbang is a clean-tech and green business news website that provides daily updates to more than 80,000 investors, C-level executives, entrepreneurs, and corporate intranets. The website began as a blog, but now also acts as a global news resource with journalists reporting from four continents. The daily posts are published on CNBC’s website. Greenbang is based in London, UK. It is a privately owned limited company and part of the Tolléjo Media Group.Labels: More important information

Tuesday, November 18, 2008

Wells Fargo's Energy Audit

Wells Fargo has some ways to save money on energy costs. While we're at it, check out Oregon's Energy Trust solutions: Home & Business.

Labels: Invest in the Future, Make a Difference, Real Solutions

Saturday, November 15, 2008

Why the Energy Crisis Will Oulast the Credit Crisis

By the year 2030, about 97% of the world's new carbon emissions will come from outside the United States and Europe, largely from China, India and the Middle East, who will consume about half the world's energy. Before global habits begin to change permanently, greenhouse gas output will keep rising, probably at least until 2020. By which time the financial crisis of 2008 might seem like ancient history.

International Energy Agency analysts predict that governments will need to spend about $4.1 trillion on alternative energy development over the next two decades.

Labels: Invest in the Future, More important information, Physics and Facts

Friday, November 14, 2008

What is the true cost of energy?

Robert Rapier discusses the "Energy Return on Energy Invested" (or Energy Out vs. Energy In) on his blog - relative to oil from Tar Sands. For anyone wanting to go forward based on facts (instead of politics) this would be a good read.

Great interivew about the future of energy

Charlie Rose interviewed Charlie Maxwell and Daniel Yergin about the future of energy. If you are seriously interested in this topic, it is worth the time to watch!

Labels: Invest in the Future, More important information, Political Action, Real Solutions, Supply and Demand

Wednesday, November 12, 2008

Energy investments of over $1 trillion per year needed.

According to the IEA*, of the share of the world’s energy consumed by 2030, almost all of the increase in fossil-energy production occurs in non-OECD countries. These trends call for energy-supply investment of $26.3 trillion to 2030, or over $1 trillion/year.

* International Energy Agency

Labels: Invest in the Future, Physics and Facts

Now is not the time to let our guard down.

The International Energy Agency (IEA), in its World Energy Outlook for 2008, says prices could increase to as much as $200 a barrel by 2030. "The immediate risk to supply is not one of a lack of global resources but a lack of investment where it is needed."

Labels: More important information

Monday, November 10, 2008

A Transition Plan for Securing America's Energy Future

(This is an update. The prior post had a javascript "link". Sorry for the inconvenience!)

Labels: Make a Difference

Sunday, November 09, 2008

Obama's Impact on Green-tech

The political and investment environment are shaping up to be just right for investments into green-technology acceleration.

Labels: Invest in the Future, Political Action

Saturday, November 08, 2008

Bankers, consumers... now automakers

Everyone wants a bailout! Whatever happened to our advice to the Japanese when their economy went south in the 1990s? We (U.S. policymakers) told them to let banks fail, in order to cleanse the system of those who should never be allowed to survive. All others would become stronger as a result, and the economy would ultimately recover in a more robust manner. I huess we don't listen to our own words.

Now - because the automakers never did (really) understand [1] what consumers wanted, nor [2] what was going to happen in a peak-oil-world, they want a bail-out, too. And D.C. is considering it!(?). This will only give them the money they need to keep spending the way they have. What happens if one of them fails? The others will become stronger! What happens if we bail them out? They continue their spendthrift ways, without the wake-up call they need.

Opinion alert: I do not think we should reward bad behavior! With all the largess, hyper-inflation will be headed our way, soon enough. Keep an eye open for it.

Labels: Supply and Demand, Unintended Consequences

Investments in Clean-Tech increasing

Even with economic uncertainty, clean-tech investments are growing:

From Energy Central:

"Ernst & Young surveyed 150 global companies and found that 90 percent of them were involved with some type of climate change initiative. As such, those businesses had planned to spend a combined $276 billion over the next 10 years to achieve their objectives. Basically, a lot of firms that had been allocating investments to high-tech in the late 1990s are now creating clean tech divisions. GE, for example, has allocated $2 billion just to its wind unit."

Labels: Invest in the Future, Physics and Facts

Just curious...

What happened to the greedy oil executives?

When gas prices were skyrocketing, everyone was blaming greedy oil companies. Now that gas prices have dropped, does this mean oil execs are no longer greedy? Or the cause?

Since oil is a commodity, it is purely supply & demand that drives oil prices up... or down. With a global recession, prices have dropped precipitously. That's what happens. Therefore, we ought to take this time to reinvigorate renewable energy technology acceleration. NOT go back to being asleep at the wheel.

Since oil is a commodity, it is purely supply & demand that drives oil prices up... or down. With a global recession, prices have dropped precipitously. That's what happens. Therefore, we ought to take this time to reinvigorate renewable energy technology acceleration. NOT go back to being asleep at the wheel.Labels: Physics and Facts, Real Solutions, Supply and Demand

Friday, November 07, 2008

Thursday, November 06, 2008

"Power corrupts;

absolute power corrupts absolutely"

And so it begins... "In the first sign of Democratic intraparty strife since the election, Rep. Henry A. Waxman (D-Calif.) has told colleagues that he plans to challenge the House's most senior member, Rep. John D. Dingell (D-Mich.), for the chairmanship of the Energy and Commerce Committee."

"Power corrupts; absolute power corrupts absolutely"

What are the consequences of Cap & Trade?

Now that Obama has been elected, with a majority in both houses, a Cap & Trade scheme to reduce carbon emissions is all but assured. What does mean to the economy, industry & energy prices? The Economist had a great article about it last year. Perhaps being open to other ways to reduce carbon emissions might be in order.

Labels: Physics and Facts, Unintended Consequences

EIA Predicts $100 oil

The Energy Information Agency predicts that oil till get back to $100/barrel soon and soar to $200/ barrel by 2030. With [1] peak oil, [2] demand from China & India, and [3] significant efforts to cut carbon emissions, I suspect $200 / barrel will be reached far sooner and we will see even $500/barrel. If for no other reason, due to the $1 trillion in bailouts this country has spent / will spend in the next few months. Why? This will drive down the value of the dollar (even though it is firming in today's economic climate), which will drive up the price of gas. This of course, will be good for renewable energy and renewable energy technologies.

Labels: More important information

Tuesday, November 04, 2008

Logic ahead of politics? This just in!

President elect Obama indicates (because of having to choose his priorities) that he is more interested in supporting renewable energy (The Cause) than he is paying to deal with climate change (The Effect), that he may need to focus limited resources on funding renewable energy.

This is a GREAT (tough) decision, and application of real-world financial reality. Bravo!

"An ounce of prevention is worth a pound of cure!"

Labels: Political Action

Monday, November 03, 2008

VeraSun Energy files for bankruptcy

The VeraSun Energy Corporation, which accounts for roughly 7 percent of ethanol production capacity in the United States, announced that it had filed for Chapter 11 bankruptcy protection late Friday.

As reported in this blog since 2005, corn ethanol just doesn't "pencil out":

=> Corn ethanol is just bad science and bad business.

=> Corn ethanol is not the answer.

=> Is Ethanol really right for the economy and environment?

=> Oregon's Renewable Energy Action Plan.

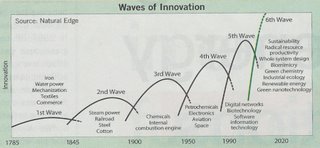

We need a 21st Century Energy Initiative that relies on science (not political whim) to develop the new technologies to get us through to the next century!

Labels: Physics and Facts, Supply and Demand, Unintended Consequences

Saturday, November 01, 2008

The Death of Capitalism?

Or... how a brief economic history informs our current economic situation

To be clear, I am a free-market, capitalist and believe very strongly that the market knows better than any government could. However, a few things have transpired that concern me greatly, and should bring pause to others:

[1] In response to the banking failures of 1929, two acts of Congress came to pass: the Glass-Steagall Act and Banking Act of 1932/33, which prohibited banks from investing and limited interest rates among other things.

In March of 1980, Regulation Q (from that time period) was repealed. The "Savings & Loan Crisis" ensued. (Ronald Reagan was president.)

[2] In 1999, other provisions prohibiting bank holding companies from owning other financial companies were repealed. Robert Kuttner (co-founder The American Prospect) has criticized the repeal of the Glass-Steagall Act as contributing to the 2007 subprime mortgage financial crisis. (In 1999, Bill Clinton was president.)

[3] The Bretton-Woods system of 1944 provided that the United States would maintain the dollar value of gold at $35 and the other national central banks would maintain the dollar value of their currencies. If all countries were fixed to the dollar and the dollar was fixed to gold, the fixed exchange-rate system was anchored to gold, a design that prevented monetary inflation.

[4] In 1971 the Bretton Woods Agreement was effectively disbanded and gold increased to $140 an ounce. Inflation became rampant and in fact, stagflation (recession and inflation - the worst of both worlds) came into being. (Richard Nixon was president.)

A major cause of oil (and gold) inflation has to do with the precipitously falling dollar - due in no small part on how our U.S. economy has been led (read Government spending). Or mis-led. By both democrats and republicans alike.

[5] In the strong economy of the 1950s and 1960s, we had utilities who were encouraged to find ever-more profitable ways to reduce energy costs. Passing a portion on to consumers while being allowed to keep some of it (in case we forget, they are called profits.). Now we seem to discourage this behavior. Since the 1973 oil embargo, we have viewed oil companies as the bad guys, and taxed their "excess" profits. The unintended consequence of this is that they did not invest as they could have, ramping up our dependence on foreign oil resulting in much higher gas prices.

[6] In the strong economy of the 1950s and 1960s we had smaller budget deficits, Republicans weren't in cahoots with Democrats (in spending our hard-earned $s), nor were they spending on hundred-million $ bridges to nowhere. Or multi-billion $s no-exit-strategy wars.

[7] In the strong economy of the 1950s and 1960s, utilities were rock-solid. Banks were rock-solid. Inflation was tamed. The United States led the world financially and morally. In ethical behavior. In Doing What Is Right.

[8] Outsourcing: From a business perspective, it "seemed" like a good idea to export our jobs to lower-wage (read lower-quality / lower-ethic) countries. But with contaminated pet food, lead in toys and counterfeit software and other products, we are finally waking up to the fact that not everyone has the same ethics as Americans.

[9] BRIC: Brazil, Russia, India and China are growing at such a rate that their economies are (also) driving up oil prices.

[10] Obesity and being a victim: Americans seem to feel the Government owes them a living. Including free health care. Which will require vast sums of money and cause further erosion in the value of the dollar. The deferred gratification that comes with longer life (later) due to better behavior (now) seems to be a difficult concept to grasp for most Americans.

If you put all these seemingly disparate facts / events together, one can see how this came about: Death by a thousand cuts: Those cuts being the erosion of profit as a true motivator (led by anti-capitalists), and one can see where this may head. Sooner than later. It is interesting that this contrarian view makes sense when unwinding unintended consequences caused by too much government meddling.

(Side note: Portland is a microcosm of this mismanagement: We are spending precious time and resources on naming streets and building bike paths instead of creating an environment where clean, sustainable businesses are encouraged to set up shop - to bring in a net in-flow of people to the community. Instead, we tax businesses and investors and only realize the unintended consequences after many move out.)

We have a choice in front of us. We have the talent, resources, capitalist (read free-choice) system and capability to lead the world: economically, technologically, politically and even morally.

Rearranging deck chairs on the Titanic seems to be the status quo from our political leaders. Voted in by a disenfranchised electorate.

The United States deserves more. Its citizens deserve more. And you deserve more.

We need leadership. We need focus. And we need to marshal our collective will and considerable resources to work together to solve all these problems, in a way that bodes well for our children and grandchildren.

Instead of the political parties trying to undermine one another, instead of the PUC disincentivizing utilities to find innovative ways to move to clean energy, instead of additionally taxing oil companies' profits - why not focus on what would solve many problems?

Why not focus our resources on incentivizing, supporting and even funding renewable energy technologies that would enable the United States to become a net-exporter of renewable energy? Not high-jobs-per-kilowatt-hour. But high-density, clean energy production.

A simple (simplistic?) solution is to move away from oil entirely and rely on electric vehicles, using renewable grid-electricity production. Yes, driving range is an issue. As is battery technology, but most of us drive fewer than the average range of current-technology plug-in cars. By converting even 10% to 20% of vehicle usage to electric vehicles, greenhouse emissions would decrease significantly, as would oil prices. These are business decisions, and it seems our car companies are a bit slow in "getting it".

Bottom line: The root cause of our economic problems is that we are a net importer - of goods and energy. No economy can withstand the hundreds of billions of dollars being sent to non-friendly states. The root cause of us being a net-importer is that in general, we are complacent. Yes lots of great people and organizations are doing lots of great things. But America appears to be in not only a cyclical decline but a long-term decline.

Solution:

As a free country (so far), you have the ability to vote with your signature and your dollar.

Government: Let's help Government become more responsible by only voting for those who "get" this notion and actually do something by focusing on the root cause problem: Becoming a net-exporter of renewable energy and renewable energy technologies. How do we do that? With your vote. In 1980, John Anderson ran on a ticket to solve our energy problems by adding a 50 cent per gallon gasoline tax. Had this been accomplished, those billions of dollars would have been spent to solve our oil dependency. He received 7% of the popular vote. Use your signature on a letter to your congressmen and women - to fund renewable energy technology development. Your children will thank you.

Business: Only buy cars that are electric or hybrid. That is, vote with your dollars. Use your signature to write the CEOs of U.S. car manufacturers to build plug-in electrics. Then buy them.

Labels: Make a Difference, Political Action, Political Inaction, Unintended Consequences

Repeat of 1970s!

"Those who cannot remember the past are condemned to repeat it." *

Here we go again: Delays in renewable / alternative energy initiatives are beginning.

* George Santayana

Labels: More important information, Political Inaction, Unintended Consequences

.jpg)